Objective The objective of this Public Ruling PR is to explain - a The tax treatment in relation to benefit in kind BIK received by an employee from his employer for exercising an employment and b The method of ascertaining the value of BIK in order to determine the amount to be taken as gross income from employment of an employee. 12004 Income from Letting of Real Property.

The section mandates that certain BIK exemptions like Maternity expenses traditional medicine are not extended to directors of controlled companies sole proprietors and partnerships.

. No Subject of Public Ruling. Benefit In Kind is a non-cash allowance. Benefit In Kind Public Ruling Ghana As The Eu S Migration Partner Dgap Generally you can only deduct charitable contributions if you itemize deductions on schedule a form 1040 itemized deductions.

A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia. Objective The objective of this Public Ruling PR is to explain - a The tax treatment in relation to benefit in kind BIK received by an employee from his employer for exercising an employment and b The method of ascertaining the value of BIK in order to determine the amount to be taken as gross income from employment of an employee. The above Public Ruling can be viewed and downloaded from the IRBs.

Perquisites are taxable under paragraph. 23 From the year of assessment 2008 the following benefits-in-kind are also exempted from tax. A Discounted price for products or services purchased from employer b Monthly telephone or broadband services provided by employer.

B Second Addendum to Public Ruling No. In relation to that the taxpayers are entitled for tax exemption for the following. Prescribed average life span Years Motorcar.

Accommodation or motorcars provided by employers to their employees are treated as income of the employees. See more of MKT Associates on Facebook. The explanations provided in this Addendum in relation to the exemption on certain benefits-in-kind are as provided under the Income Tax Exemption Order 2009 - PU.

A Ruling may be withdrawn either wholly or in part by. Kitchen utensils equipment. On 17 April 2009 The Inland Revenue Board IRB has released the 3r d Addendum Public Ruling on Benefits In Kind.

2 Gardener RM3600 per gardener 3 Household servant RM4800 per servant 4 Recreational club membership a Indiviudal membership Membership subscription paid or. It sets out the interpretation of the Director General in respect of the particular tax law and the policy as well as the procedure applicable to it. Thats because we need to file tax exemptions based on LHDNs Public Ruling 112019 for the valuation of BIK under section 83 Non-application.

A public ruling is an expression of the commissioners opinion about. 82000 Wilful Evasion of Tax and Related Offences. This benefit is treated as income of the employees.

Fund as a disability superannuation benefit to the split tpd life insured. Benefits-In-Kind dated 8 November 2004. VOLA is gross income from employment under paragraph 131c of the ITA.

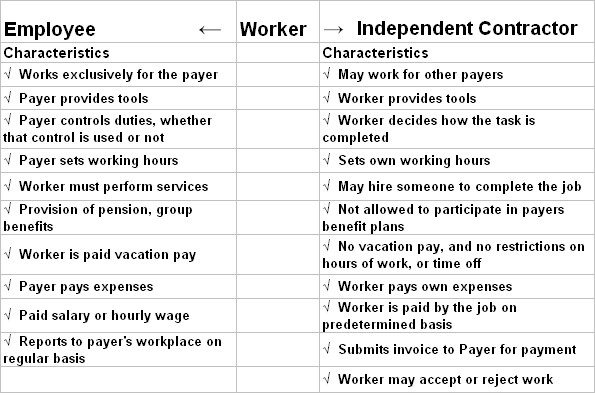

Benefits in kind are taxable under s 131b of the ITA unless specifically excluded. Public Ruling 112019 - Benefits in Kind. The Public Ruling No.

The flat-rate estimate of these benefits is laid down by the Royal Decree implementing the Income Tax Code 1992 RDBITC 92. Generally non-cash benefits eg. Swimming pool detachable sauna.

That perquisites are convertible into cash whereas benefits in kind are not. No Subject of Public Ruling. Public Ruling No32013 Benefits In Kind This Ruling has been published to merge Public Ruling No22004 issued on 8 November 2004 with a Addendum to Public Ruling No12004 dated 20 May 2005.

44 VOLA is living accommodation benefit provided for the employee by or on behalf of the employer. For further calculation on Benefit In Kind ruling refer here. The most common type of Benefit In Kind are.

Treatment on BIK is explained in detail in the Public Ruling No. The tax treatment in relation to benefit in kind bik received by an employee. 22004 dated 17 January 2006.

And d Fourth Addendum. It sets out the interpretation of the Director General of Inland Revenue in respect of the particular tax law and the policy and procedure that are to be applied. The tax treatment in relation to benefits-in-kind BIK received by an employee from his employer for exercising an employment.

22004 2nd Addendum Benefits-In-Kind. The tax treatment on VOLA is explained in. Benefits in kind which are excluded include medical or dental treatment and childcare 2 leave passage for travel within and outside Malaysia 3 benefits or amenities for the.

72000 Providing Reasonable Facilities And Assistance. 22004 issued on 17 January 2006. 52019 INLAND REVENUE BOARD OF MALAYSIA Date of Publication.

Public Ruling 122019 Tax treatment of foreign exchange gains and losses. The method of ascertaining the value of BIK in order to determine the amount to be taken as gross income from employment of an employee. The Director General may withdraw this Public Ruling either wholly or in part by.

In the updated public ruling the irb has provided further. These benefits are called benefits in kind BIK. The malaysian inland revenue board mirb issued a new public ruling pr on.

A ruling is issued for the purpose of providing guidance for the public and officers of the Inland Revenue Board of Malaysia. Pages 31 of 31. 19 November 2019 42 Perquisites are benefits in cash or in kind which are convertible into money received by an employee from his employer or from third parties in respect of having or exercising an employment.

PR 112019 essentially updates PR 32013 to incorporate changes to the law since PR 32013 was issued. 22004 1st Addendum Benefits-In-Kind. Objective The objective of this Public Ruling PR is to explain - a The tax treatment in relation to benefit in kind BIK received by an employee from his employer for exercising an employment and b The method of ascertaining the value of BIK in order to determine the amount to be taken as gross income from employment of an employee.

C Third Addendum to Public Ruling No12004 dated 17 April 2009. 32013 Date of Issue. Stereo set TV video recorder CD DVD player.

Public Ruling 112019 - Benefits in Kind PR 112019 issued on 12 December 2019 replaces PR 32013 of the same topic. This Ruling explains. The Federal Public Service Finance published Circular 2018C57 on 15 May 2018 on the flat-rate valuation of the benefit in kind for providing an immovable property or a part of an immovable property free of charge to employees or managers.

There are several tax rules governing how these benefits are valued and reported for tax purposes.

Mass Casualty Commission Interim Report

Canadian Tax News And Covid 19 Updates Archive

Causality Is Propensity Score Matching A Must For Scientific Studies Cross Validated

Court Ruling Shows Failure By Bc S Public Guardian Says Victim The Tyee

Law Is Alberta Ending Coronavirus Restrictions Because Of Failing To Provide Evidence Of Sars Cov2 Virus Existence In Court Skeptics Stack Exchange

Toronto Drop In Networks Drop In News Covid 19 Guidance And Resources For Drop Ins

Canadian Tax News And Covid 19 Updates Archive

Toronto Drop In Networks Drop In News Covid 19 Guidance And Resources For Drop Ins

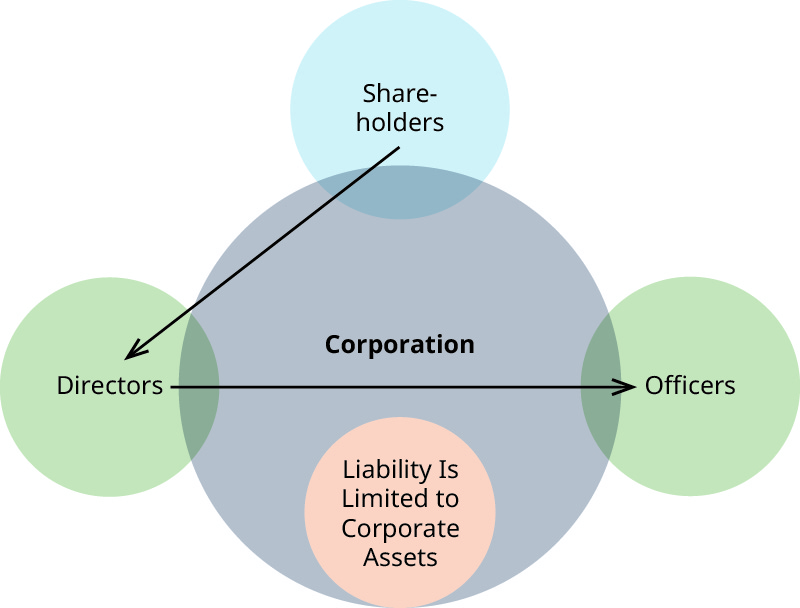

Corporate Law And Corporate Responsibility Business Ethics

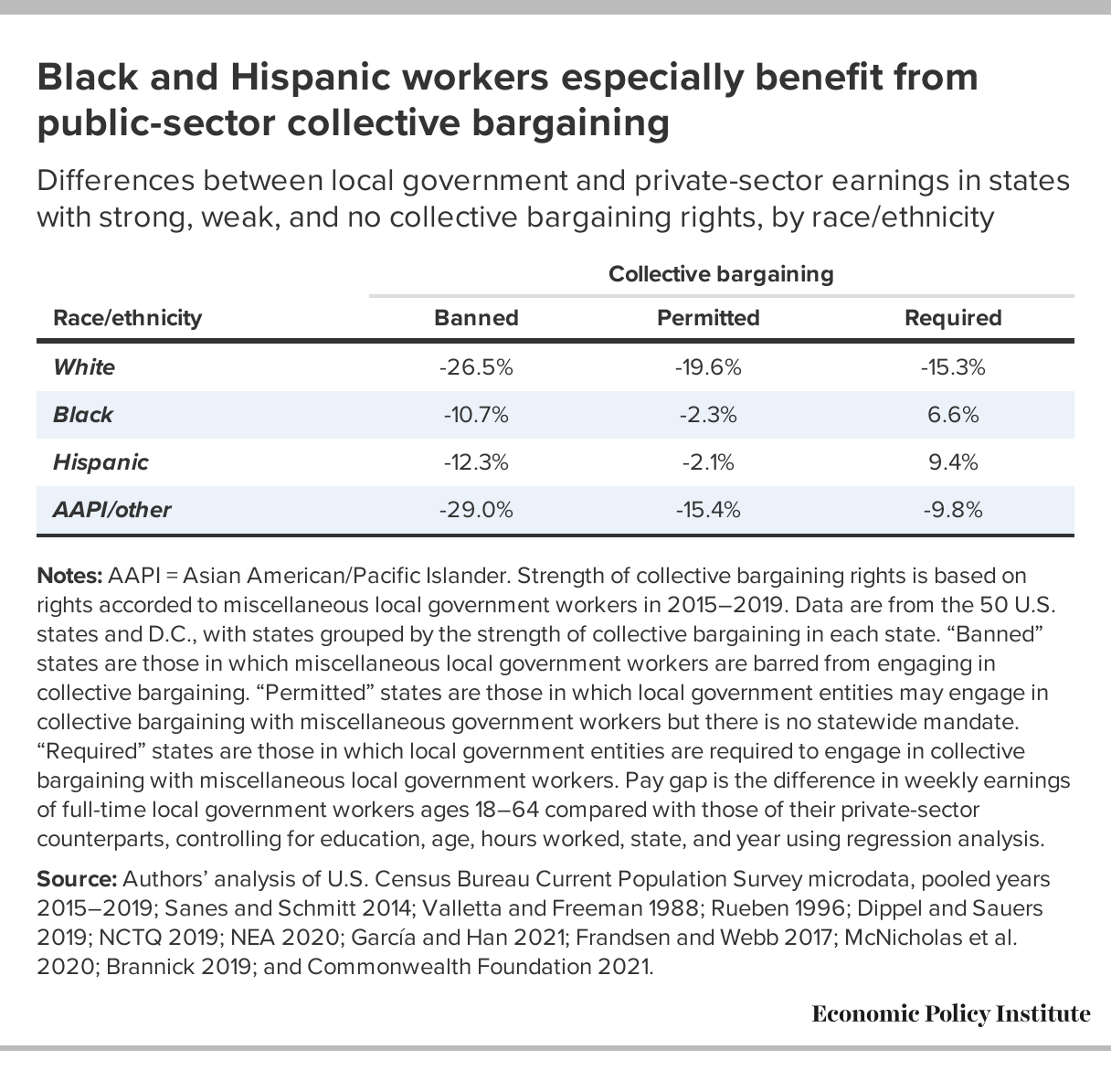

Unions Can Reduce The Public Sector Pay Gap Collective Bargaining Rights And Local Government Workers Economic Policy Institute